NDIS sees disability groups cut care

Originally published by Rick Morton on 13 September 2017 in The Australian.

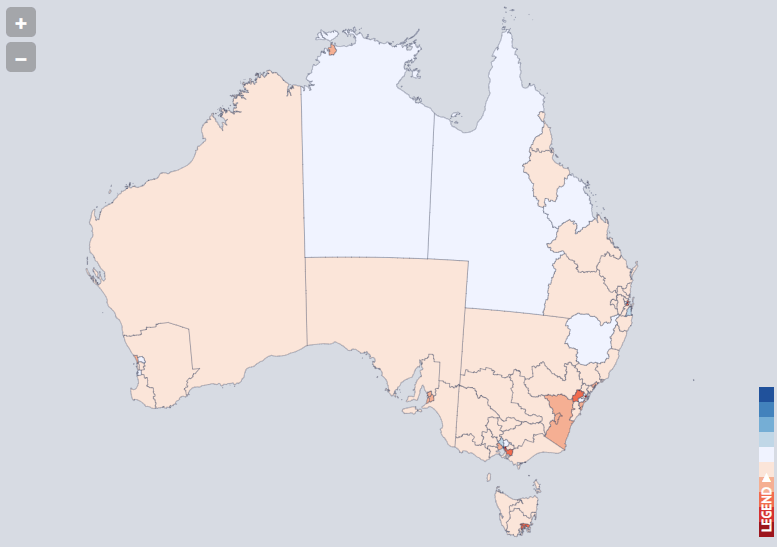

Major disability service providers such as CatholicCare Sydney are shutting down or getting out of the business because they cannot make a profit under a pricing regime set by the $22 billion National Disability Insurance Scheme.

New research from the University of Western Australia shows profits among small disability service providers fell to 4 per cent in 2015-16 while profits of large bodies continued to grow from a low margin to 3.6 per cent.

The longitudinal study of a panel of 154 service providers, conducted by UWA’s David Gilchrist, backs market concerns that have been ringing for years: that more money under the NDIS will not ensure survival. “Even among the largest providers, who overall are increasing profit, they actually aren’t making money from disability services,” Professor Gilchrist said. “That profit is almost uniformly coming from other areas of the business.” All services in the study are not-for-profit organisations but depend on profit margins to remain solvent.

The Australian has learned Catholic Care Sydney has stopped providing respite care and short-term accommodation as a disability service because the NDIS pays only a flat daily rate and the charity cannot make the case to continue. The flat rate does not reflect penalty rates and other costs. Even sentiment is down. Two thirds of providers in UWA’s 2014-15 panel rated their organisation’s financial performance as strong or very strong but the following financial year this plunged to 40 per cent. However, the true scale of the market transformation under the NDIS remains to be seen, as NDIS funding represented only 3 per cent of total income in 2015-16, despite growth of 108 per cent in a year.

National Disability Services is the peak body for providers and its chief executive, Ken Baker, told The Australian prices under the NDIS were “extremely tight”. “The key question is: do the not-for-profit providers have sufficient working capital and do they see sufficient growth in the future to continue? That’s not entirely clear just now,” he said. “The scheme’s prices are extremely tight and there needs to be profit … so providers can expand and respond to huge growth in demand.”

As it stands, the National Disability Insurance Agency both funds disability support for more than 100,000 people —that figure will be 460,000 at full rollout in 2020 — and sets the prices providers can charge for their services, a position the Productivity Commission views as a conflict.

A review of its pricing structure will be finalised by the end of the year and, at some point, prices will be decentralised. “Providers are making these decisions now, to get out of certain disability services, and the (NDIA) needs to respond now rather than wait for that review,” Mr Baker said.

Professor Gilchrist said the scheme’s pricing encouraged cheap labour. “We’re seeing this pressure for organisations that have been around a long time to offload experienced staff for very cheap staff and that has implications for quality,” he said. “In the past, funds were provided in advance to organisations, so even if they weren’t technically solvent they could survive. That is not the case any more under the NDIS.”

The UWA research shows total income for the panel of organisations hit $2.6bn while expenses crept past $2.5bn. Median profit fell to 3.8 per cent from 3.9.